1 Blue-Chip Dividend Stock That Still Has Room to Run

Merck (MRK) may be a storied pharmaceutical giant with a 134-year history, but it still has a lot of room to run. Merck is well-known for its cancer treatment Keytruda, vaccine leadership, and a growing pipeline of innovative therapies in cardiovascular, diabetes, and infectious diseases.

Over the years, Merck has done what few large-cap pharma companies can: Deliver consistent earnings power combined with pipeline dynamism and capital discipline.

Despite headwinds, this pharma heavyweight delivered second-quarter results that were in line with expectations and reaffirmed its strategic roadmap. Regardless of the stock’s 20% year-to-date decline, most analysts believe it is a “Buy” with a potential 80% increase from current levels. Let’s find out if the stock is indeed a buy now.

Merck Has a Multi-Therapeutic Growth Engine

In the second quarter, total revenue fell 2% year over year to $15.8 billion, owing primarily to a $1.3 billion decline in Gardasil sales in China. However, excluding this, underlying global sales increased by 7%, driven by strong demand for oncology, animal health, and new launches. Merck’s most valuable asset is Keytruda, an immunotherapy drug that treats a variety of cancers such as melanoma, head and neck cancer, lung cancer, and breast cancer, among others. Keytruda sales increased 9% to nearly $8 billion, driven by increased use in both metastatic and early stage cancers, particularly in women.

Gross margin improved to 82.2%, thanks largely to a favorable product mix. However, adjusted earnings dropped 7% to $2.13 per share. Merck has launched a multi-year optimization initiative to redirect $3 billion from its least profitable business into high-potential pipeline and commercial opportunities.

Despite concerns about the long-term patent expiration of Keytruda, management stated that a new generation of products is gaining traction. The company is constantly reshaping its portfolio, reallocating resources from mature segments to support over 20 new and emerging growth drivers. The recent acquisition of Verona Pharma, which includes the novel COPD therapy Ohtuvayre, is an excellent example. This move adds to Merck’s expanding cardiopulmonary portfolio. Furthermore, drugs such as Winrevair (for pulmonary arterial hypertension), Enflonsia (for RSV), Capvaxie (a new pneumococcal vaccine), and others are already scaling well. Currently, Merck has more than 80 Phase 3 clinical trials underway across oncology, cardiology, infectious disease, and immunology. These provide a glimpse into the company’s future beyond Keytruda.

In oncology, Merck is also preparing for the post-Keytruda era. Through a collaboration with Daiichi Sankyo, Merck is advancing ifinatamab deruxtecan, an antibody-drug conjugate, in three pivotal Phase 3 trials targeting esophageal, prostate, and small-cell lung cancers. Additionally, the company has collaborated with Moderna (MRNA) on mRNA-4157, a personalized cancer vaccine for melanoma.

In vaccines, Merck is advancing its dengue vaccine candidate (V181) into Phase 3, addressing one of the fastest-growing viral threats worldwide. Additionally, Merck continues to push the boundaries in HIV prevention and treatment. The company has initiated two Phase 3 trials in collaboration with the Gates Foundation for MK-8527, a once-monthly oral HIV prevention pill.

Merck is also a dividend stock, with a yield of 4.1%, which exceeds the healthcare sector average of 1.6%. With a dividend payout ratio of 33%, the company has plenty of room to grow its dividends.

For the full year, management anticipates a 1% to 2% increase in revenue between $64.3 billion and $65.3 billion. Gross margin is expected to remain at a healthy 82%, with adjusted earnings per share ranging from $8.87 to $8.97. Notably, this outlook excludes the impact of Verona Pharma’s pending acquisition, leaving room for potential upside in the coming quarters.

Analysts covering Merck expect earnings to grow by 16.7% in 2025, followed by another 7.7% increase in 2026. Merck’s shares are currently trading at nine times forward 2025 earnings, making it an attractively priced biotech company that delivers innovation, pipeline momentum, and strong cash flows.

What Does Wall Street Say About Merck Stock?

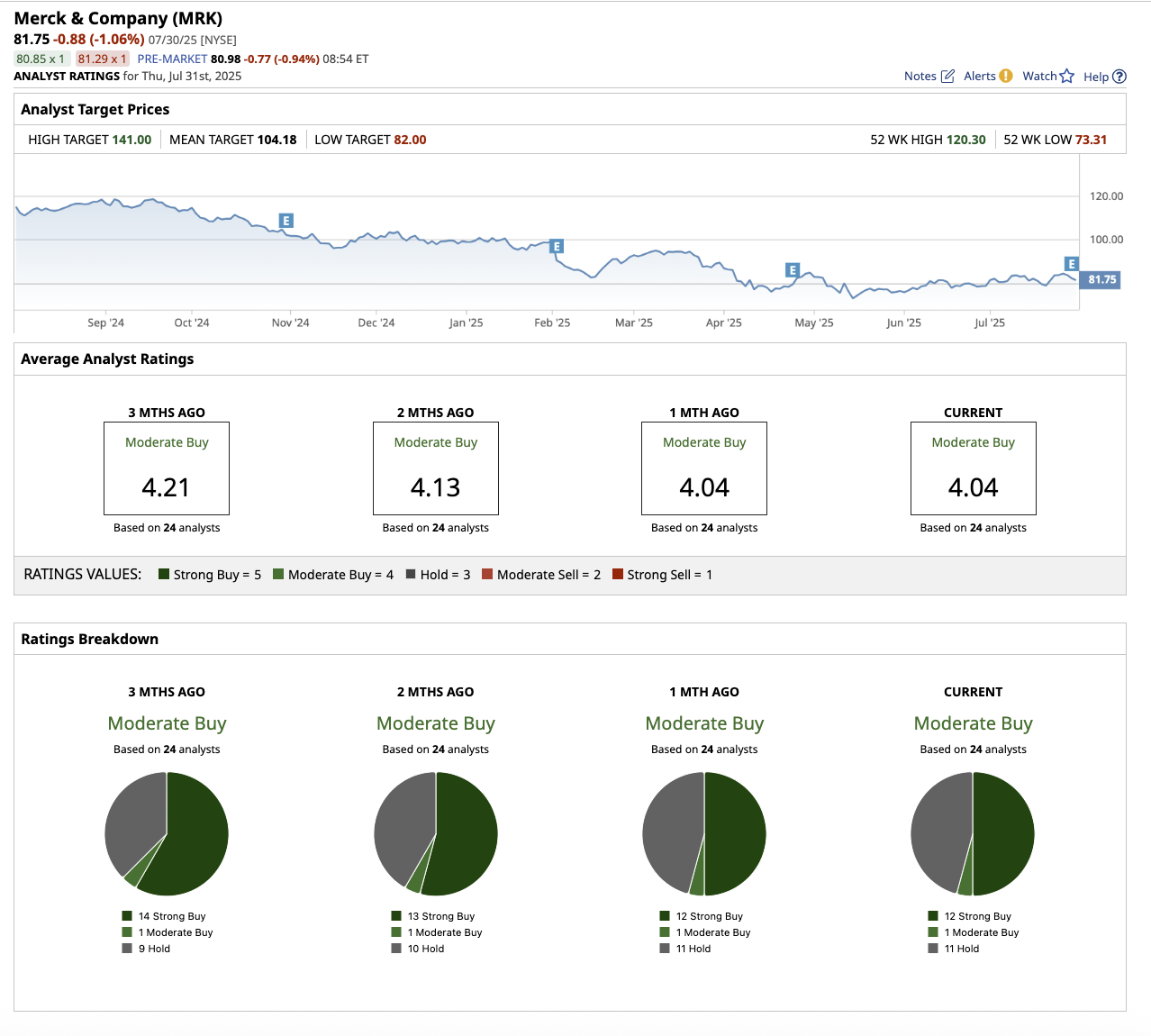

Overall, Merck stock holds a “Moderate Buy” rating. Among the 24 analysts covering the stock, 12 have assigned a “Strong Buy” rating, while one recommends a “Moderate Buy” and 11 suggest holding. The average price target of $104.18 suggests potential upside of 33% from current levels, while the highest price estimate of $141 indicates the stock could surge by 80% over the next year.

The Key Takeaway

This pharmaceutical behemoth may be over a century old, but with innovation at its core and multiple shots at success in high-need disease areas, Merck still has plenty of room to expand its reach. Long-term investors seeking growth, income, and pipeline-driven upside should consider including it in their portfolios.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.