This Energy Dividend Stock Is Slashing a Massive 25% of Jobs. Is This a Sign to Stay Far, Far Away?

ConocoPhillips (COP) is bracing for significant workforce reductions as it steps up efforts to tighten costs across its operations. The oil giant plans to cut 20% to 25% of its global employees and contractors, translating to approximately 2,600 to 3,250 roles worldwide.

A company spokesperson noted that most of these reductions are expected to be completed before the end of 2025, signaling a determined approach to streamline operations amid shifting market dynamics. The news sent COP shares down 4.4% on Sept. 3, dragging the stock 17.5% below its 52-week high of $116.08.

The company’s latest quarterly earnings report further emphasized its focus on cost efficiency, revealing over $1 billion in identified cost savings and margin optimization opportunities. In addition, ConocoPhillips agreed to divest its Anadarko Basin assets for $1.3 billion, reinforcing its strategy to bolster liquidity and concentrate on core operations.

With the workforce cutbacks underway and stock prices under pressure, investors are now scrutinizing the company’s position to determine the right stance on COP stock.

About COP Stock

Headquartered in Houston, Texas, ConocoPhillips engages in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, liquefied natural gas, and natural gas liquids. The company commands a market cap of nearly $118.2 billion and operates across six business segments: Alaska, Lower 48, Canada, Europe, the Middle East and North Africa, Asia Pacific, and Other International.

As the largest explorer and producer in the world in terms of proved reserves and production, the company maintains a dominant footprint in the energy sector. Despite the scale, COP stock has faced headwinds, sinking 11.7% over the past year and 3.4% year-to-date (YTD).

Yet recent market momentum has offered some relief, with the stock climbing 11.5% over the past three months.

COP trades at 1.97 times sales, above the industry average but below its five-year historical range, suggesting a relative discount considering robust operational performance.

The company distributes an annual dividend of $3.12, delivering a yield of 3.3%. Its latest dividend of $0.78 was paid on Sept. 2 to shareholders of record on August 18, underscoring a commitment to returning capital to investors even amid strategic cost reductions.

A Closer Look at ConocoPhillips’ Q2 Earnings

On Aug. 7, ConocoPhillips released its second-quarter 2025 earnings, presenting a blend of achievements and challenges relative to market expectations. Revenue rose 4.3% year-over-year (YoY) to $14.7 billion but fell slightly short of the Street’s forecast of $15.25 billion.

Production remained a bright spot, with ConocoPhillips delivering 2,391,000 barrels of oil equivalent per day, surpassing the high end of its guidance. In the Lower 48, daily production averaged 1,508,000 barrels of oil equivalent, while Alaskan and international operations contributed 883,000 barrels per day, boosted by completed turnarounds in Norway and Qatar.

Adjusted EPS declined 28.3% YoY to $1.42, slightly exceeding consensus estimates of $1.40. At quarter-end, the company held $5.7 billion in cash and short-term investments, alongside $1.1 billion in long-term investments, reinforcing a healthy liquidity position.

Management has reaffirmed full-year 2025 production guidance at the midpoint, narrowing ranges to account for the anticipated impact of the Anadarko Basin sale, expected to close at the start of the fourth quarter of 2025, reducing production by roughly 40,000 barrels of oil equivalent per day.

Analysts project COP’s third-quarter fiscal 2025 EPS to fall 18% YoY to $1.46, with the full-year 2025 bottom line declining 17.8% to $6.40. Looking ahead to 2026, EPS is expected to ease slightly by 5.5% to $6.05, suggesting a moderated slowdown following strategic divestments and cost efficiencies.

What Do Analysts Expect for COP Stock?

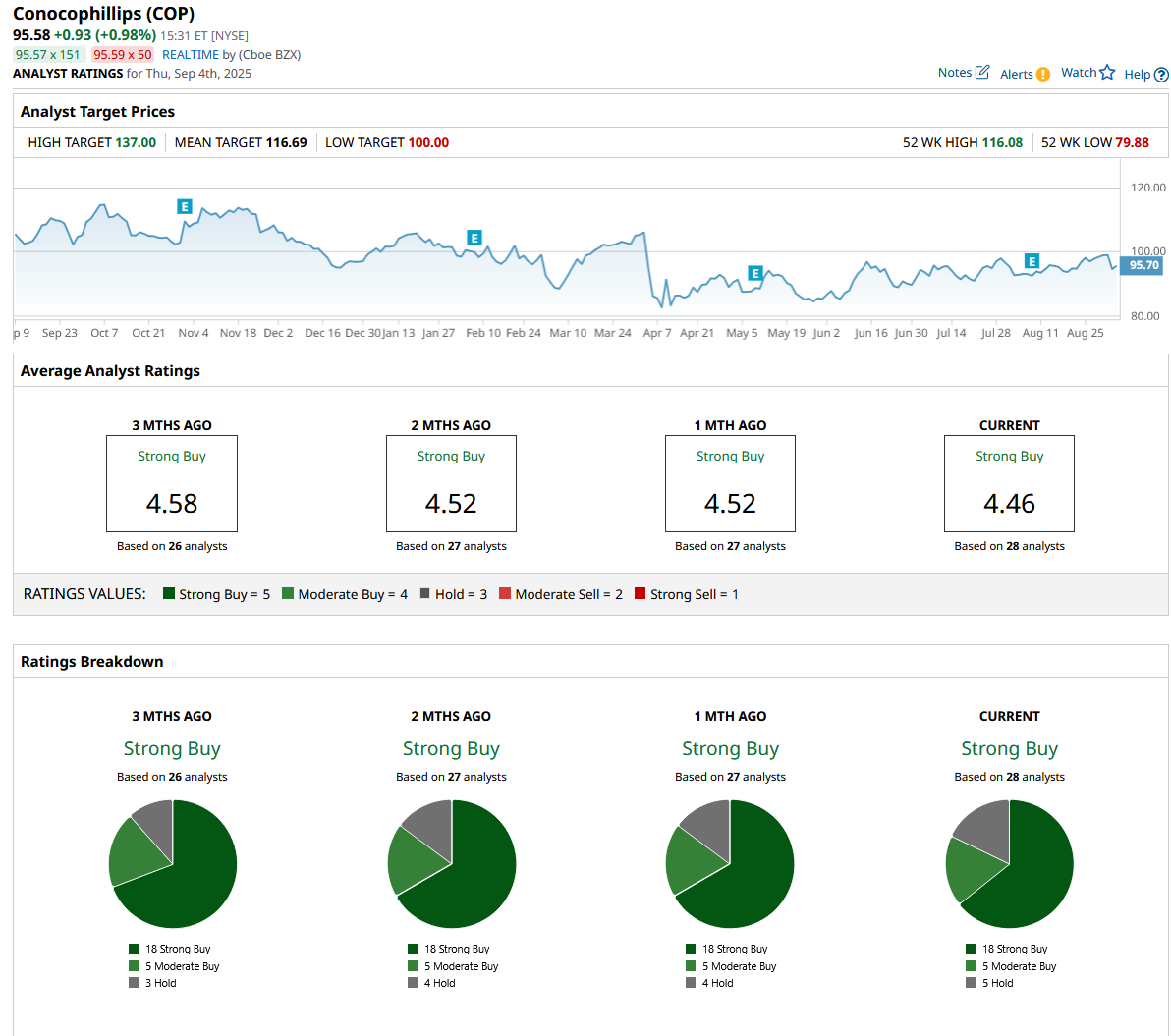

Analyst sentiment for COP remains largely favorable despite recent volatility. Among the 28 covering the stock, COP holds a consensus rating of “Strong Buy.” Of these, 18 analysts explicitly recommend “Strong Buy,” five favor “Moderate Buy,” while another five suggest “Hold.”

Price targets indicate meaningful upside potential. COP’s average price target of $116.69 represents potential upside of 22%, while the Street-high target of $137 reflects a 43% potential gain from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.