Apple's Big Event on September 9 Could Be a 'Game Changer' for AAPL Stock

/Apple%20Inc%20Tim%20Cook-by%20John%20Gress%20Media%20Inc%20via%20Shutterstock.jpg)

Apple's (AAPL) upcoming "Awe Dropping" event on Sept. 9 could mark the beginning of the most significant iPhone transformation in years, according to analysts at Evercore ISI, who believe the launch represents the start of a multi-year strategic shift.

The centerpiece will be the introduction of four new iPhone 17 models, including the highly anticipated iPhone 17 “Air,” which could be Apple's thinnest handset ever, at just 5.55 mm thick, roughly 35% thinner than the current iPhone 16 lineup. Evercore described the Air as Apple's "most notable design change to the iPhone in recent years."

The event comes at a critical juncture for AAPL stock. Shares of the iPhone maker have underperformed the broader tech sector in 2025, falling 4.5% year-to-date (YTD). However, Apple grew iPhone sales by 13.5% year over year to $44.6 billion in fiscal Q3 of 2025 (ended in June).

Long-Term Vision Takes Shape

Beyond the upcoming launch, Evercore analysts highlighted Apple's ambitious roadmap, which extends through 2027. Apple reportedly plans to introduce its first foldable iPhone in the fall of 2026, featuring a book-style design with a 7.8-inch inner display and an estimated starting price of $2,000. The 2027 "iPhone 20" could represent an even more radical transformation, featuring four-sided curved glass that eliminates bezels entirely for Apple's 20th anniversary model.

The Sept. 9 event represents more than a typical product refresh. Instead, it may be the opening phase of Apple's most ambitious hardware strategy since the original iPhone launch, designed to reinvigorate growth and maintain premium market positioning amid intensifying competition.

Is Apple Stock a Good Buy Right Now?

In fiscal Q3, Apple reported record sales of $94 billion, representing a 10% year-over-year (YoY) increase. The revenue growth was driven by the strong performance of the iPhone 16 family, while Services reached an all-time record of $27.4 billion, growing 13% annually.

CEO Tim Cook highlighted broad-based demand across geographic segments, with Apple setting upgrade records for iPhone, Mac, and Apple Watch. The installed base reached new highs across product categories, providing a solid foundation for future Services growth.

Apple is increasing its artificial intelligence (AI) investments, with capital expenditures rising significantly as it expands its private cloud compute infrastructure. Alternatively, tariff-related costs surged to $800 million in the quarter, with management projecting $1.1 billion in September.

The management also acknowledged that consumer search behaviors are "evolving," potentially threatening Apple's traditional search access point advantages as AI platforms gain prominence.

What Is the Target Price for AAPL Stock?

Apple remains financially robust with a strong ecosystem but faces meaningful headwinds that could pressure margins and growth. Analysts tracking AAPL stock forecast revenue to increase from $391 billion in fiscal 2024 (ended in September) to $533.3 billion in fiscal 2029. Comparatively, adjusted earnings per share are forecast to expand from $6.75 per share to $12 per share in this period.

Today, AAPL stock trades at a forward price-to-earnings (P/E) multiple of 31.2x, which is higher than its 10-year historical average of 20x. If the stock reverts to its historical mean multiple, it should trade around $240 in early 2029, which is similar to its current price.

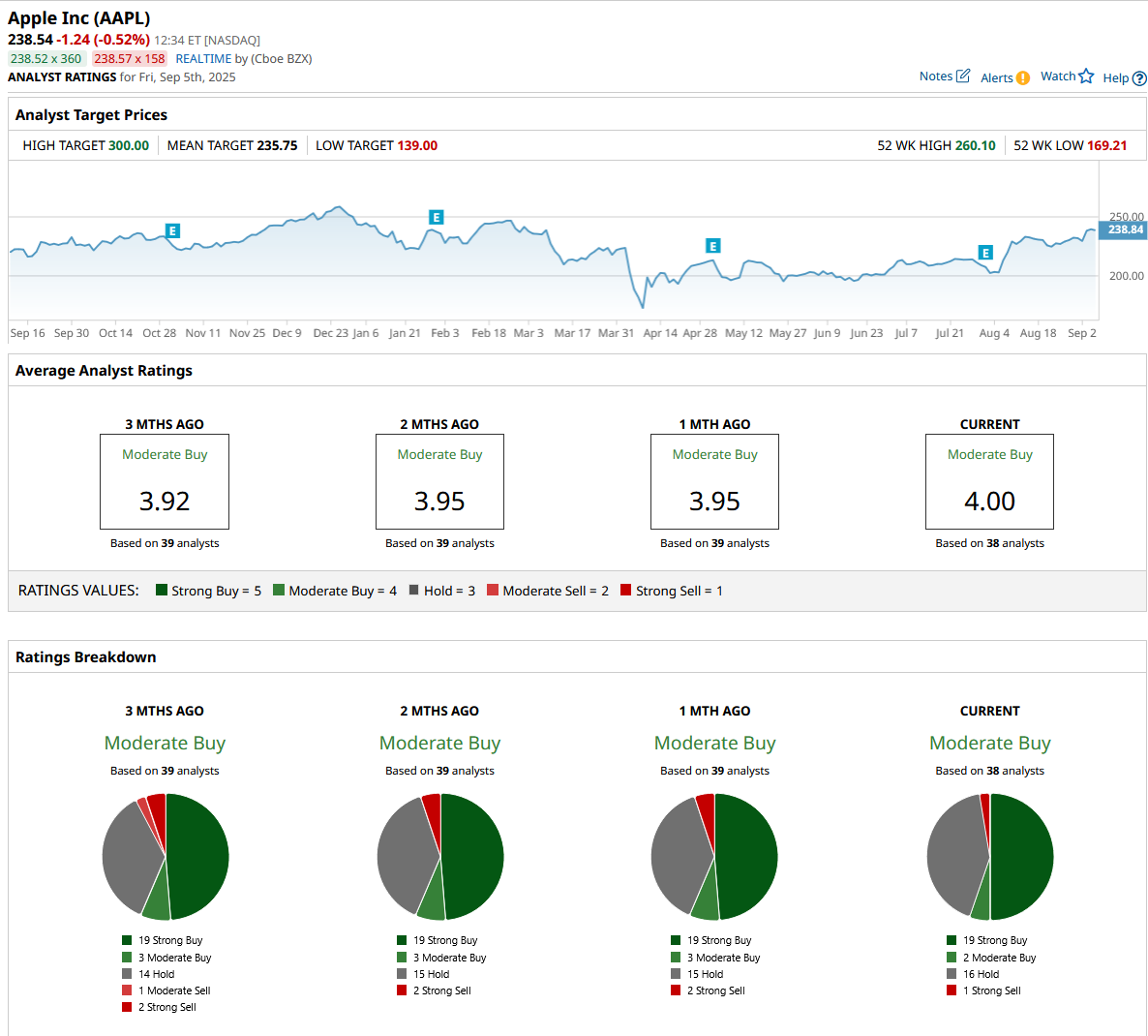

Out of the 38 analysts covering AAPL stock, 19 recommend “Strong Buy,” two recommend “Moderate Buy,” 16 recommend “Hold,” and one recommends “Strong Sell.” The average AAPL stock price target is $235, which is below the current trading price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.