Insiders Keep Selling CoreWeave Stock. Should You?

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

CoreWeave (CRWV) stock is down 53% from its all-time high as insider selling accelerated following the expiration of the artificial intelligence (AI) data center company's post-IPO lockup period. The rapid-fire sales raise serious questions about whether investors should follow suit or view this as a buying opportunity.

Insiders have dumped over seven million shares since August, according to Bloomberg data. CEO Michael Intrator sold 32,455 shares for $3.1 million, while SVP Goldberg Chen offloaded 56,294 shares worth $5.2 million. Notably, major shareholder Magnetar Financial liquidated over seven million shares, reducing its stake by 17% in a single transaction.

CoreWeave went public in March at $40 per share and rocketed to above $183 in June before crashing to current levels around $88. The sale occurred after disappointing Q2 results showed mounting interest expenses, with revenue growth more than tripling.

The timing coincides with broader AI sector volatility, as investors question valuations amid regulatory concerns and Nvidia's (NVDA) recent earnings disappointment. Many sales were executed under Rule 10b5-1 plans, suggesting that predetermined strategies were employed rather than panic.

Is CoreWeave a Good Stock to Own?

In Q2 of 2025, CoreWeave reported revenue of $1.2 billion, an increase of 207% year-over-year (YoY). More importantly, CoreWeave achieved its first quarter with both $1 billion in revenue and $200 million in adjusted operating income, demonstrating the business model's potential profitability at scale.

The AI infrastructure company concluded Q2 with a revenue backlog of $30.1 billion, providing substantial visibility into future performance. Further, expansion contracts with both hyperscaler customers in recent weeks validate the platform's competitive positioning.

CoreWeave's purpose-built AI infrastructure has earned recognition as the sole "platinum" provider in independent research, positioning it favorably against both traditional hyperscalers and emerging competitors.

However, several red flags demand attention. The massive insider selling following the expiration of the lockup period suggests that internal stakeholders view current valuations as unsustainable. When CEOs and major shareholders dump millions of dollars in stock immediately after restrictions are lifted, investors should pay attention.

CoreWeave's capital intensity remains extreme, with Q2 CapEx hitting $2.9 billion and full-year guidance of $20-23 billion. While the company has successfully reduced borrowing costs, it still carries substantial debt with interest expenses of $267 million in Q2 alone, a fourfold increase YoY.

The proposed $9 billion Core Scientific acquisition introduces complexity and integration risk, as CoreWeave's declining stock price renders the all-stock deal less attractive to the target company.

What Is the CRWV Stock Price Target?

Analysts tracking CRWV stock forecast revenue to rise from $5.25 billion in 2025 to $25.8 billion in 2029. Comparatively, adjusted earnings are forecast to improve to $3.61 per share in 2028, compared to a loss of $1.50 per share in 2025.

If CRWV stock is priced at 50x forward earnings, which is reasonable given its growth estimates, CRWV stock will trade around $180 in early 2028, indicating an upside potential of over 100% from current levels.

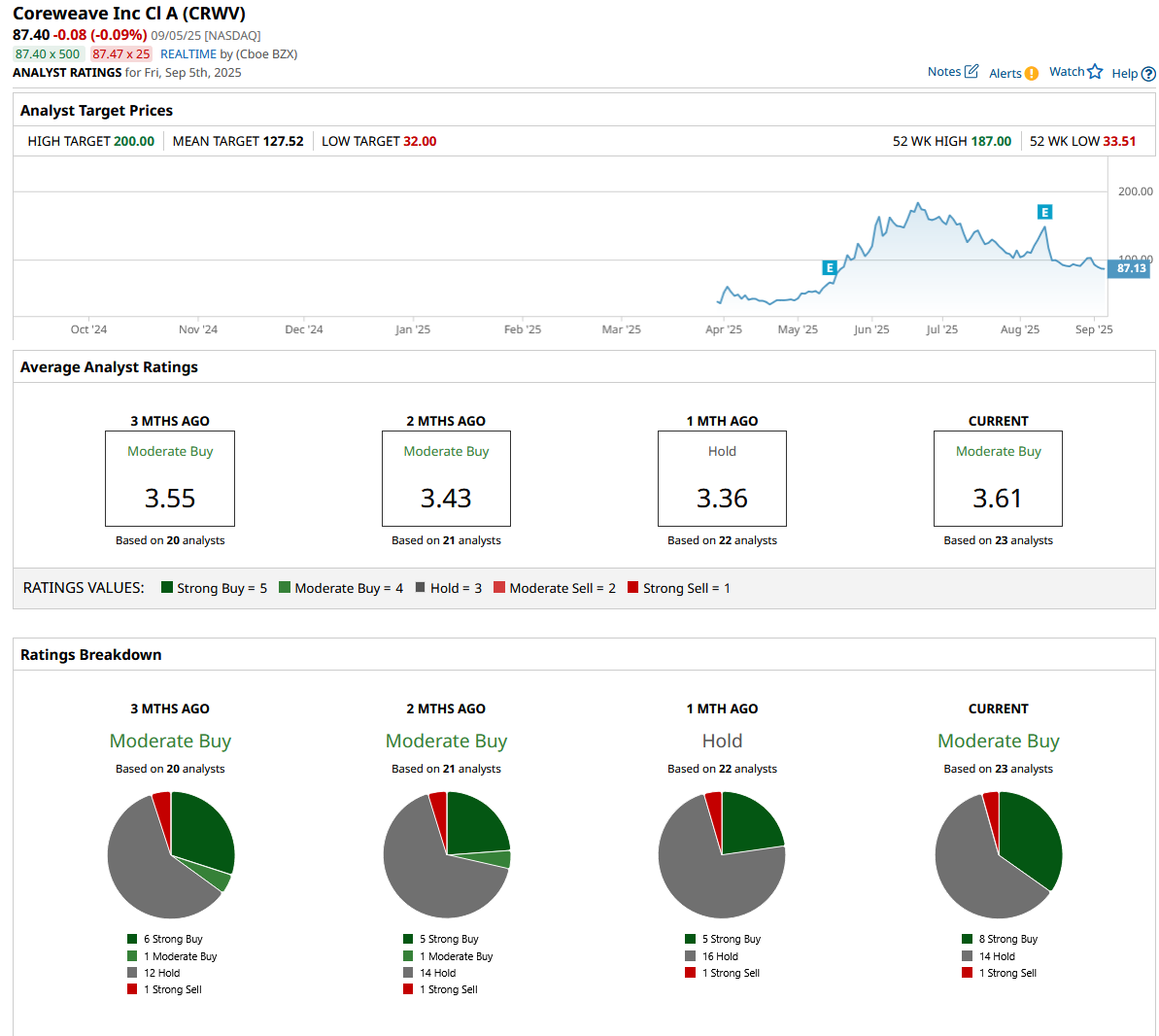

Of the 23 analysts covering CRWV stock, eight recommend “Strong Buy,” 14 recommend “Hold,” and one recommends “Strong Sell.” The average CRWV stock price target is $128, which is above the current price of $87.50.

CoreWeave's situation reflects both company-specific challenges and broader sector concerns. The company's mounting debt, unprofitability, and the potential impact on its $9 billion Core Scientific acquisition add uncertainty.

For investors, the insider exodus represents a clear warning signal. Until CoreWeave demonstrates sustainable profitability and the AI infrastructure sector stabilizes, the smart money appears to be heading for the exits.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.