Down 7% in the Past Month, Should You Buy the Dip in Nvidia Stock Today While You Still Can?

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

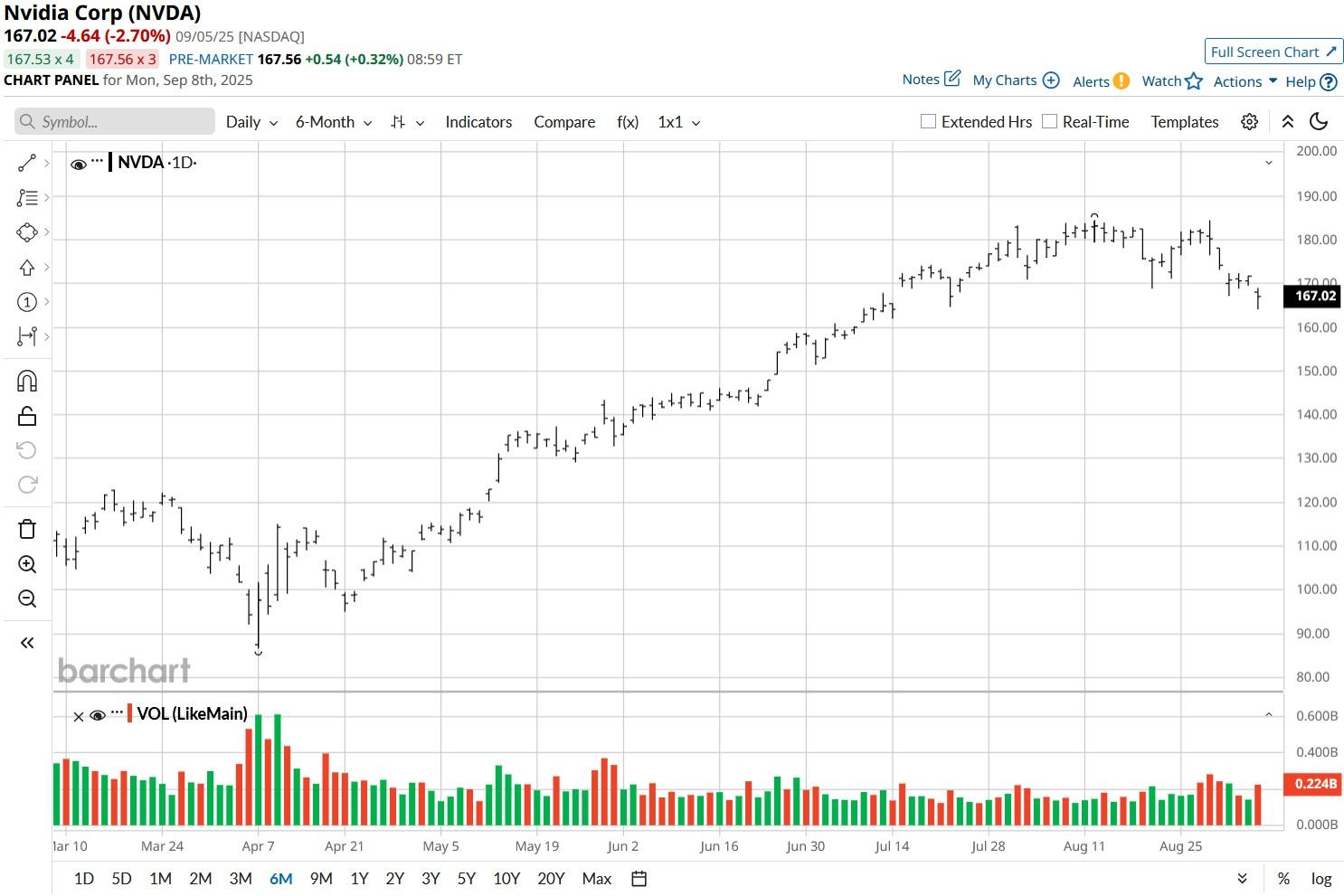

Nvidia (NVDA) shares closed 2.7% lower on Friday after peer Broadcom (AVGO) confirmed its custom chips (XPUs) are now gaining traction among hyperscalers.

The company has reportedly secured a $10 billion commitment from OpenAI which serves as a headline-grabbing example of the momentum it talked about on the latest earnings call.

Despite recent declines, however, Nvidia stock remains a lucrative investment in 2025. At the time of writing, the semiconductor behemoth is up roughly 96% versus its year-to-date low in April.

Why Did Nvidia Stock Tumble After AVGO Earnings?

NVDA stock pulled back following Broadcom’s earnings and bullish commentary mostly because they cast a shadow over the chipmaker’s long-standing dominance in AI hardware.

While Nvidia’s general-purpose GPUs remain the gold standard for training large models, AVGO’s surge in XPU deployments signals a shift in buyer preference, particularly among hyperscalers seeking cost efficiency and architectural control.

For NVDA investors, the concern isn’t immediate displacement. It’s the gradual erosion of pricing power and market share as custom ASICs gain traction. In a market priced for perfection, even a hint of structural competition can trigger outsized volatility.

Should You Buy the Dip in NVDA Shares?

According to a Citi analyst, Atif Malik, Broadcom deals could mean a $12 billion hit to NVDA.

Still, Malik maintained Nvidia shares at “Buy” in his latest research report, citing potential upside from China “if and when the company restarts GPU shipments” to Asia’s largest economy.

While AVGO earnings did make him lower his price objective on the AI stock to $200, that still signals potential upside of nearly 20% from current levels.

Malik agreed that robust AI spending as indicated in Broadcom’s release should, nonetheless, serve as a meaningful tailwind for the entire semiconductor industry, including Nvidia.

Moreover, a September rate cut could unlock further upside in NVDA stock as well, he concluded.

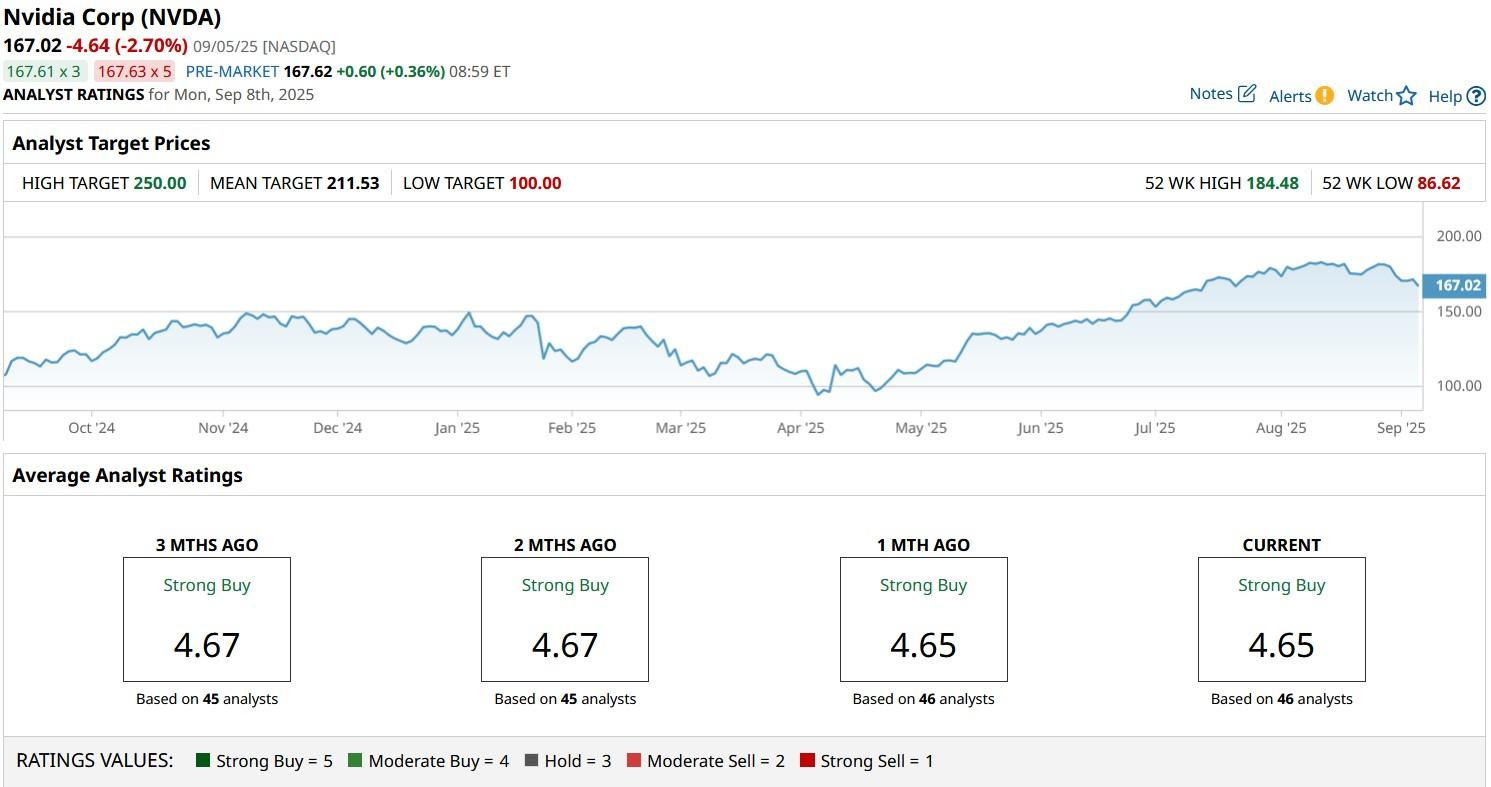

Wall Street Remains Bullish on Nvidia

Other Wall Street analysts are also keeping bullish on NVDA shares for the remainder of 2025.

The consensus rating on Nvidia stock remains at “Strong Buy” with the mean target of about $212 indicating potential upside of well over 25% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.