Is Arch Capital Group Stock Underperforming the Nasdaq?

/Arch%20Capital%20Group%20Ltd%20phone%20and%20website-%20by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $33.8 billion, Arch Capital Group Ltd. (ACGL) is a global provider of insurance, reinsurance, and mortgage insurance solutions. The company offers a broad portfolio spanning property, casualty, professional indemnity, workers’ compensation, and specialized coverages across multiple industries.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Arch Capital Group fits this criterion perfectly. Through its insurance and reinsurance units, ACG delivers tailored risk management programs, including protection for catastrophic losses, life reinsurance, and financial coverages.

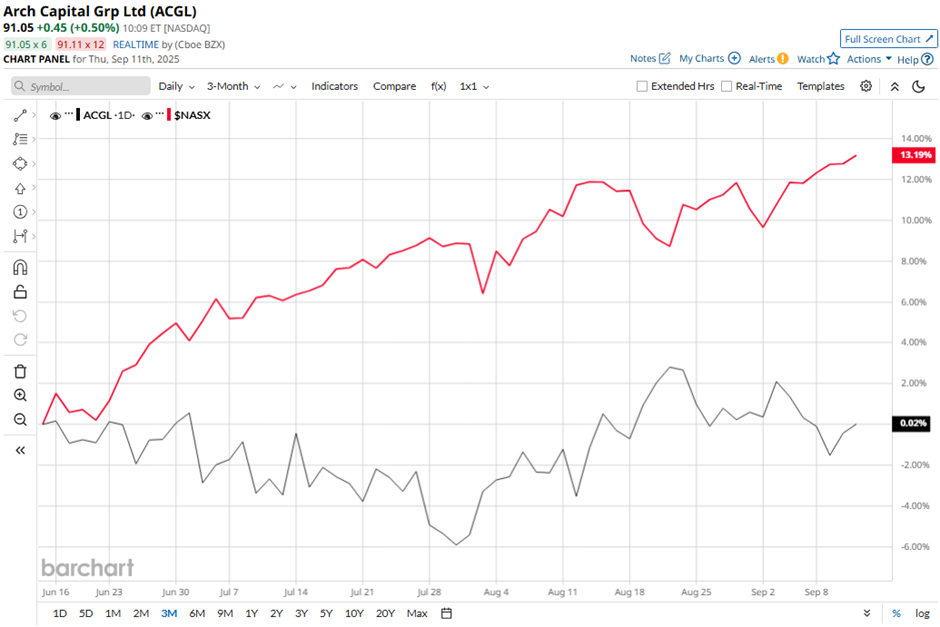

Despite this, shares of the Pembroke, Bermuda-based company have declined 22.1% from its 52-week high of $116.47. ACGL stock has risen 1.8% over the past three months, underperforming the Nasdaq Composite’s ($NASX) nearly 12% increase over the same time frame.

In the longer term, ACGL stock is down 1.5% on a YTD basis, lagging behind NASX’s 13.8% gain. Moreover, shares of the company have decreased 17.1% over the past 52 weeks, compared to NASX’s 26.3% return over the same time frame.

Despite a few fluctuations, the stock has been trading mostly above its 200-day moving average since last year.

Despite Arch Capital Group’s Q2 2025 earnings beat with operating income of $2.58 per share, investors turned cautious on weaker fundamentals. The combined ratio deteriorated 250 bps to 81.2, annualized operating ROE fell 230 bps to 18.2%, and operating cash flow declined 26% year-over-year to $1.1 billion. Mortgage insurance also lagged, with net premiums written down 8.3% and underwriting income off 17.1%, offsetting gains in Insurance and Reinsurance and leading to a marginal share pullback the next day.

In comparison, rival Fidelis Insurance Holdings Limited (FIHL) has shown a more pronounced decline than ACGL stock on a YTD basis, dropping 4.5%. However, FIHL stock has declined marginally over the past 52 weeks, outpacing ACGL’s performance during the same period.

Despite the stock’s underperformance relative to the Nasdaq, analysts remain moderately optimistic on Arch Capital Group. ACGL stock has a consensus rating of “Moderate Buy” from 19 analysts in coverage, and the mean price target of $107.65 is a premium of 18.3% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.